[ad_1]

New automotive registrations rise 10.4% in greatest March since 2019 and twentieth consecutive month of progress

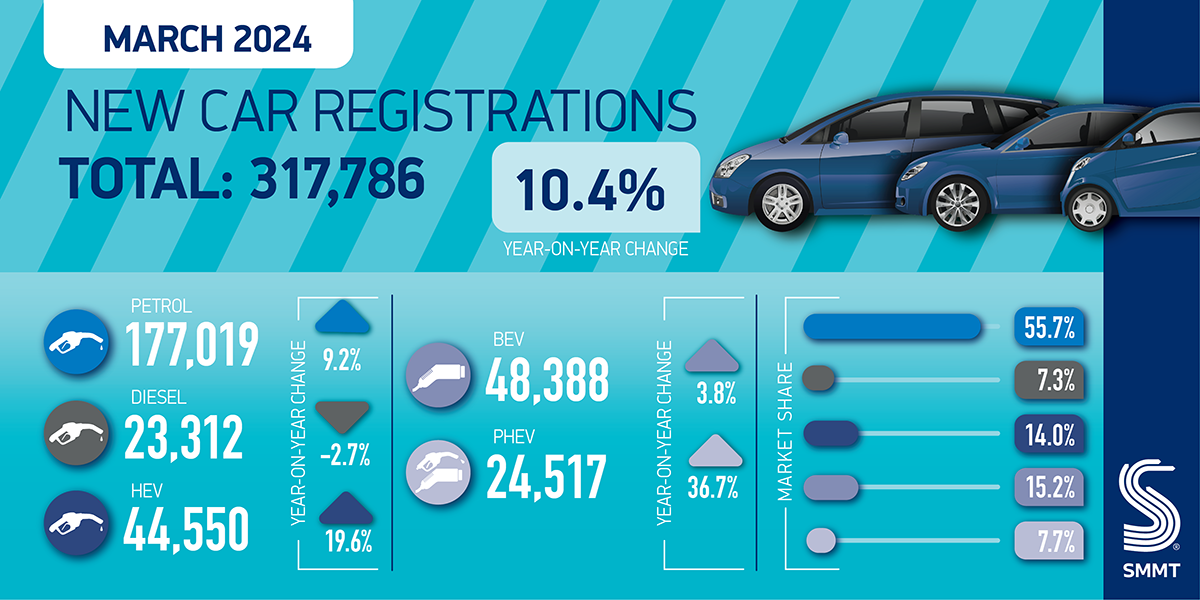

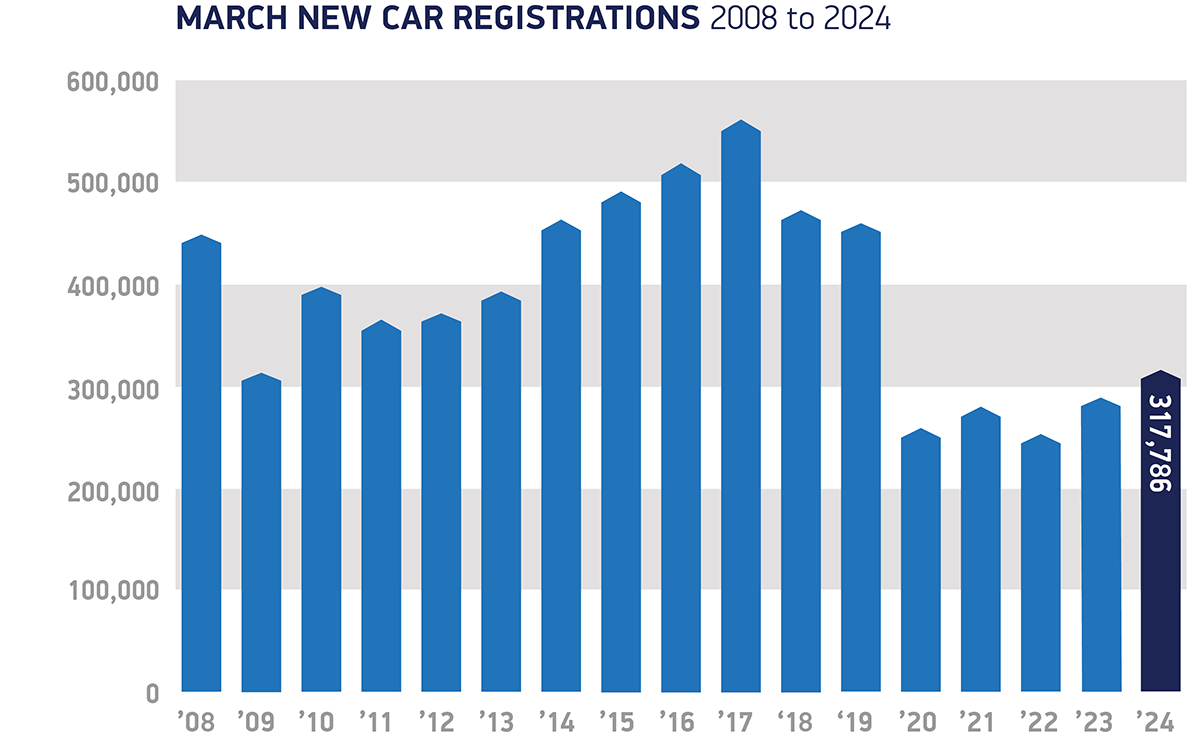

The UK new automotive market clocked up its twentieth consecutive month of progress in March, with a ten.4% rise in registrations. In what is often the busiest month of the yr because of the new numberplate, 317,786 new vehicles reached the highway with a 24 plate – the very best March efficiency since 2019, though nonetheless -30.6% beneath pre-pandemic ranges.1

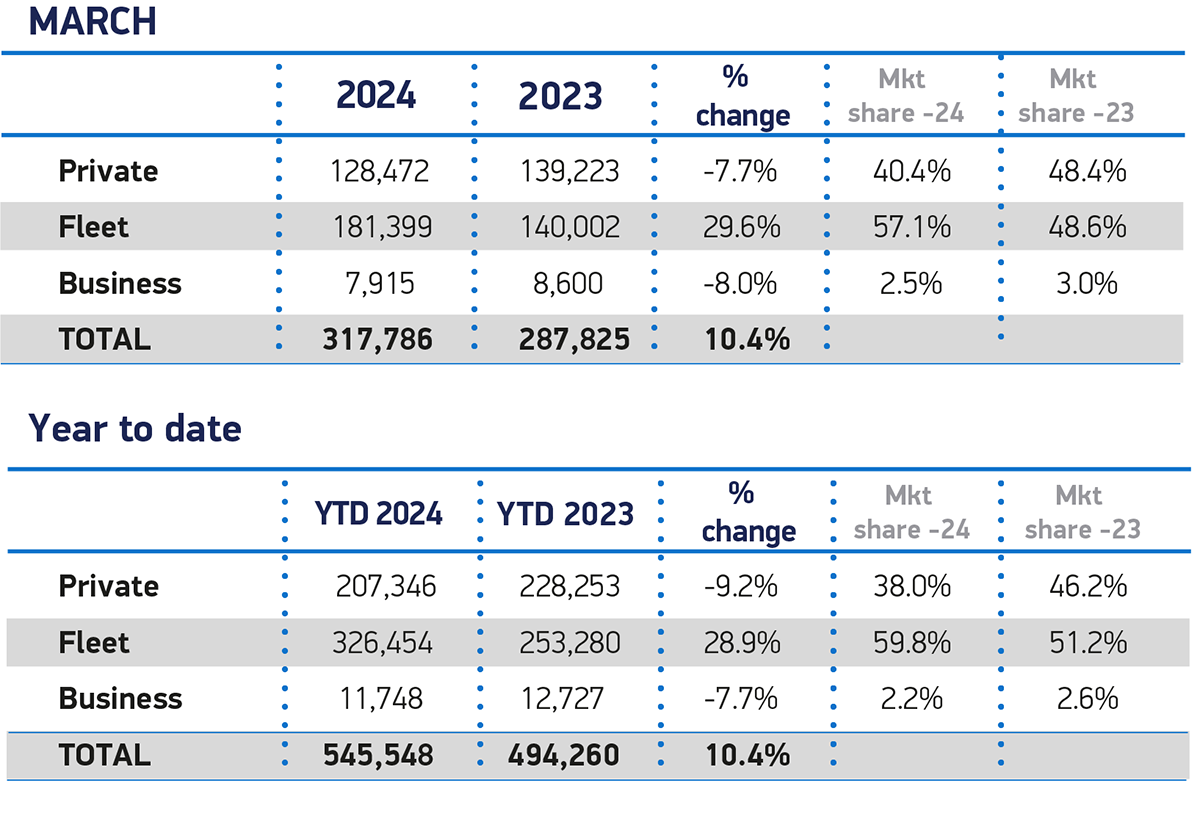

Progress was once more pushed by fleet funding, up 29.6% because the sector continues to get better following the constrained provide of earlier years. Registrations by personal consumers fell by -7.7%, with a difficult financial backdrop of low progress, weak shopper confidence and excessive rates of interest. The small enterprise registration phase, in the meantime, declined -8.0%.

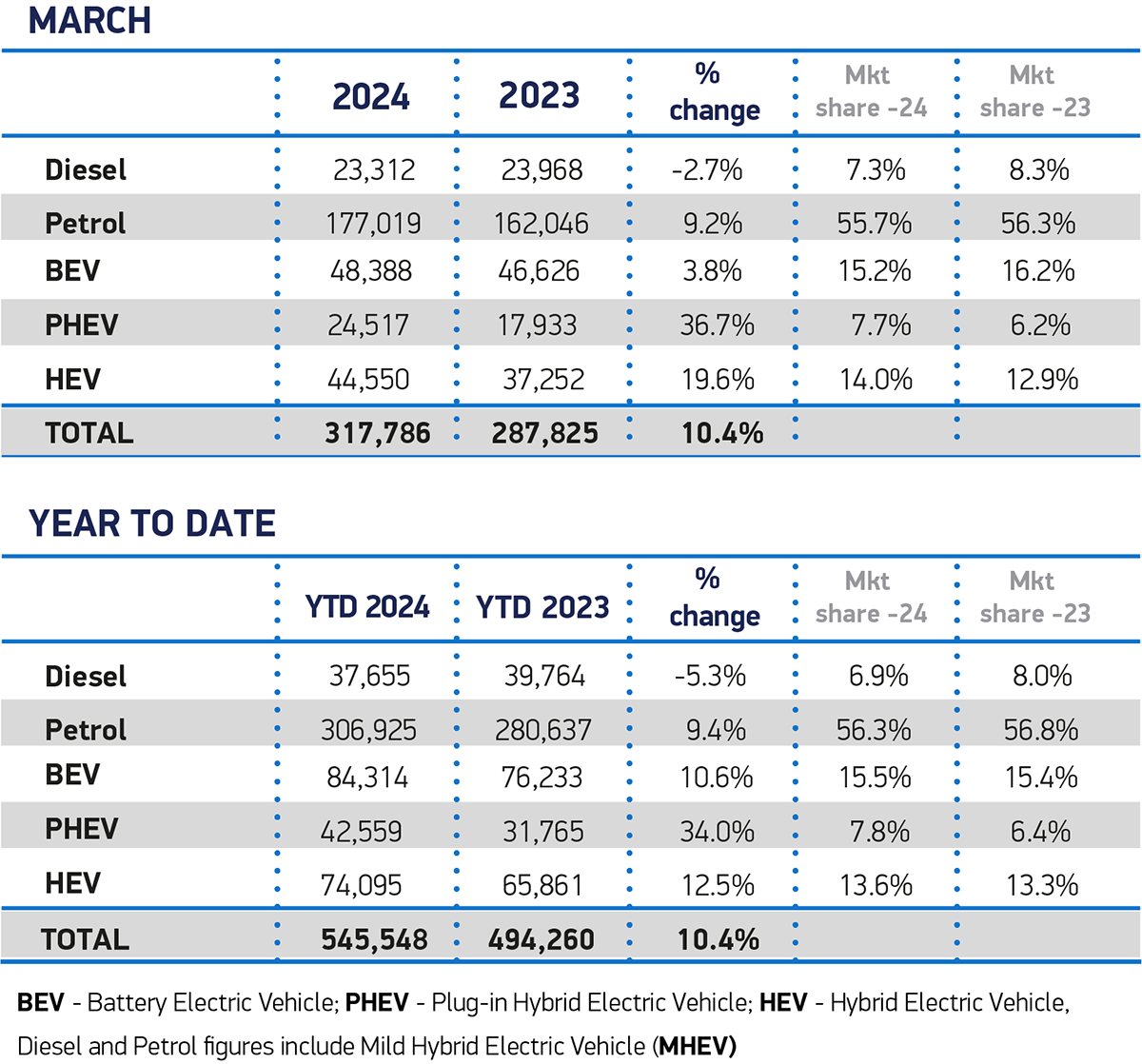

Petrol vehicles retained the lion’s share of the market, at 55.7%, with registrations up 9.2% yr on yr, as diesel volumes fell -2.7% to account for simply 7.3% of demand. Uptake of hybrid electrical automobiles (HEVs) reached file ranges, rising by 19.6% to 44,550 models and 14.0% of the market, whereas the most important share progress was recorded by plug-in hybrids, up by greater than a 3rd to 24,517 models, or 7.7% of all new registrations. Conversely, whereas battery electrical car (BEV) registration volumes have been at their highest ever recorded ranges, market share fell by one share level from the identical month final yr, down to fifteen.2%. Registrations rose 3.8%, with solely fleets displaying any quantity progress.

The autumn in BEV market share inside a rising market underscores the necessity for presidency to assist customers to hurry up fleet renewal. Giant fleets proceed to drive BEV uptake, thanks to driving tax incentives however whereas registration volumes elevated in March, market share declined. A troublesome financial backdrop makes it ever tougher for customers to put money into these new applied sciences.

Producers themselves are providing beneficiant incentives, serving to extra drivers swap to zero emission automobiles and ship authorities and trade carbon targets, however this can’t be sustained indefinitely.2 A full market transition wants incentives not only for fleet and enterprise consumers however personal retail consumers as properly, one thing that might carry the UK into line with different main markets. Quickly halving VAT on BEVs, revising the brink for the costly automotive complement on Automobile Excise Obligation subsequent April, and abolishing the ‘pavement penalty’ on public EV charging by equalising VAT charges to five% in step with residence charging, would make a big distinction to customers, serving to extra of them transfer to zero emission automobiles sooner.

Mike Hawes, SMMT Chief Govt, stated,

Market progress continues, fuelled by fleets investing after two powerful years of constrained provide. A sluggish personal market and shrinking EV market share, nonetheless, present the problem forward. Producers are offering compelling presents, however they’ll’t single-handedly fund the transition indefinitely. Authorities assist for personal customers – not simply enterprise and fleets – would ship a constructive message and ship a sooner, fairer transition on time and heading in the right direction.

1 March 2019: 458,054 registrations

2 What Automotive analysis reveals EV reductions have elevated by 204% since January 2023

SOURCE: SMMT

[ad_2]